Real regulatory compliance examples from FDA, SEC, HIPAA, and GDPR. Actual penalties, cases, and how teams stay compliant across industries.

Regulatory compliance isn't abstract. It's fines that bankrupt companies. It's executives who go to prison. It's products pulled from shelves overnight.

This guide covers real compliance examples from the regulations that matter most. Not theory. Actual cases, actual penalties, and what you can learn from them.

We'll cover:

- FDA compliance (pharma, medical devices, food)

- SEC compliance (financial services)

- HIPAA compliance (healthcare)

- GDPR and CCPA (data privacy)

- Industry-specific requirements for legal, pharma, and finance teams

What Is Regulatory Compliance?

Regulatory compliance means following the rules set by government agencies and industry bodies. Simple definition, complex execution.

For a pharmaceutical company, it means tracking every FDA guidance update. For a bank, it means monitoring SEC rule changes daily. For any company handling personal data, it means staying current with privacy laws that change constantly.

The challenge isn't understanding compliance. It's keeping up with it. Regulations change. Agencies update guidance. New rules emerge. Miss an update, and you're exposed.

FDA Compliance Examples

The FDA regulates drugs, medical devices, food, cosmetics, and tobacco. Their rules change frequently, and the penalties for missing them are severe.

Warning Letter Responses

In 2024, the FDA issued over 1,700 warning letters to companies for compliance violations. Common issues:

- Manufacturing deficiencies

- Labeling violations

- Failure to report adverse events

- Unapproved marketing claims

Real case: A medical device company received a warning letter for failing to report device malfunctions. The FDA gave them 15 days to respond. They missed the deadline because their compliance team didn't see the warning letter posted on FDA.gov.

Cost: $4.2 million in remediation, plus a consent decree limiting their operations.

The fix: Automated monitoring of FDA warning letters. Know within hours when your company or competitors receive warnings. Tools like Changeflow can track changes on regulatory pages automatically.

Drug Approval Changes

When the FDA updates drug guidance, pharmaceutical companies need to know immediately. A change to labeling requirements can affect marketing, packaging, and distribution.

In 2025, the FDA updated opioid labeling requirements. Companies had 90 days to comply. Some learned about the change from news articles, weeks after it was published.

What pharma compliance teams track:

- FDA guidance documents

- Drug approval letters

- Safety communications

- Inspection reports

Food Safety Modernization Act (FSMA)

FSMA gave the FDA authority to regulate how food is grown, harvested, and processed. The rules are detailed and they change.

Real case: A food manufacturer missed an FSMA update about produce safety. Their existing processes didn't meet the new standards. Result: a voluntary recall of $8 million in product, plus FDA inspection findings that took 18 months to clear.

Paste a URL. We'll do the rest.

Changeflow monitors the page and tells you what changed and why it matters.

Free plan available. No credit card required.

SEC Compliance Examples

The Securities and Exchange Commission regulates financial markets. Their rules affect public companies, investment firms, broker-dealers, and anyone touching securities.

Disclosure Requirements

Public companies must disclose material information. Miss a disclosure deadline, and you face enforcement action.

Real case: In 2024, the SEC fined a Fortune 500 company $35 million for failing to disclose cybersecurity incidents within the required timeframe. The company's compliance team was monitoring the wrong SEC page and missed the updated disclosure rule.

Rule 10b-5 and Insider Trading

The SEC updates guidance on what constitutes material non-public information. Compliance teams need to track these updates to train employees properly.

What financial compliance teams monitor:

- SEC rule changes

- Staff guidance updates

- Enforcement actions (learn from others' mistakes)

- Comment letters on company filings

ESG Disclosure Rules

Environmental, Social, and Governance disclosures are evolving rapidly. The SEC finalized climate disclosure rules in 2024, with requirements phasing in through 2026.

Companies that aren't tracking these updates are building compliance programs based on outdated requirements.

HIPAA Compliance Examples

HIPAA protects patient health information. Violations can cost up to $1.5 million per incident category, per year.

Breach Notification

When a data breach occurs, covered entities must notify affected individuals within 60 days. But what counts as a breach? The HHS updates guidance on this regularly.

Real case: A healthcare provider suffered a ransomware attack. They believed encryption exempted them from breach notification. It didn't. HHS guidance had been updated, and their interpretation was wrong.

Penalty: $1.2 million, plus three years of monitoring.

Business Associate Agreements

HIPAA requires specific contract language with vendors who handle patient data. The required terms have changed over time.

Companies using old BAA templates often don't include current requirements. When HHS investigates, outdated agreements become compliance failures.

What healthcare compliance teams track:

- HHS guidance updates

- OCR enforcement actions

- State health privacy laws (often stricter than HIPAA)

- CMS billing and coding updates

GDPR Compliance Examples

The General Data Protection Regulation applies to any company handling EU residents' data. Fines can reach 20 million euros or 4% of global annual revenue, whichever is higher.

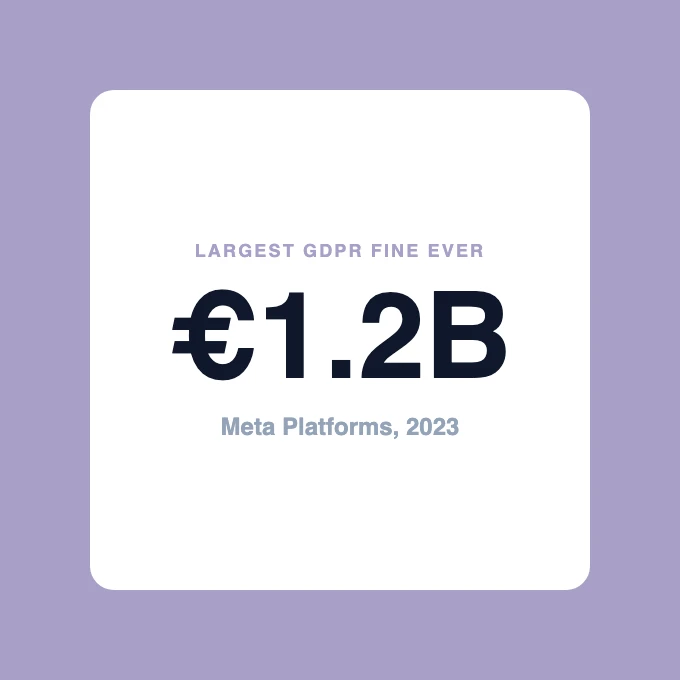

Meta's 1.2 Billion Euro Fine

In 2023, Meta received the largest GDPR fine ever: 1.2 billion euros for transferring EU user data to the US without adequate protections.

The ruling came after years of regulatory changes following the Schrems II decision. Companies that weren't tracking EU data protection authority updates were caught off guard.

Cookie Consent Requirements

GDPR cookie consent requirements have been clarified through multiple enforcement actions and guidance updates. What was compliant in 2020 often isn't compliant today.

Real case: An e-commerce company received a 90,000 euro fine for cookie consent violations. Their consent banner hadn't been updated since 2019. Three separate guidance updates had changed the requirements.

Data Subject Access Requests

Individuals can request copies of their personal data. Companies have one month to respond. The process for handling these requests has been clarified through enforcement actions.

What privacy teams track:

- EDPB guidelines

- National DPA decisions (each EU country)

- UK ICO guidance (post-Brexit)

- CJEU court decisions

CCPA and State Privacy Laws

California's Consumer Privacy Act started a wave of state privacy legislation. Virginia, Colorado, Connecticut, Utah, and more have passed similar laws. Each has different requirements.

Right to Delete Requests

CCPA gives consumers the right to delete their personal information. The California AG has issued multiple guidance updates on what "delete" means and how quickly companies must respond.

Real case: A data broker received a $1.2 million fine for failing to process deletion requests properly. Their system deleted data from the primary database but not from backups. Updated AG guidance had clarified that backups must be included.

More states are passing privacy laws. Each has slightly different requirements for definitions of personal information, consumer rights, and enforcement mechanisms. Companies operating nationally need to track updates from multiple state attorneys general.

Industry-Specific Compliance

For Legal Teams

Law firms and legal departments track regulations that affect their clients. But they also face their own compliance requirements:

- State bar ethics rules (change frequently)

- Court procedural rules (each jurisdiction)

- E-discovery requirements

- Client trust account regulations

What legal compliance looks like: A litigation support team monitors PACER, state court websites, and bar association updates. They need to know when rules change before it affects pending cases.

For Pharmaceutical Companies

Pharma compliance goes beyond FDA. Companies track:

- FDA guidance and approvals

- EMA updates (European Medicines Agency)

- Health Canada requirements

- State pharmacy board rules

- PBM policy changes

What pharma compliance looks like: A regulatory affairs team monitors 50+ government websites daily. Changes to any of them could affect product labeling, marketing, or distribution.

For Financial Services

Banks, investment firms, and fintech companies face overlapping regulations:

- SEC rules

- FINRA requirements

- OCC guidance

- State banking regulators

- CFPB rules

What financial compliance looks like: A compliance officer monitors regulatory websites before markets open. Any overnight changes need to be flagged to trading desks and client-facing teams.

How to Stay Ahead of Regulatory Changes

Option 1: Manual Monitoring

Some teams check regulatory websites manually. Every day, someone visits FDA.gov, SEC.gov, and a dozen other sites looking for updates.

Problems:

- Time-consuming (hours per day)

- Easy to miss changes

- No audit trail

- Doesn't scale

Option 2: Email Subscriptions

Government agencies offer email alerts. The FDA has GovDelivery. The SEC has email subscriptions.

Problems:

- Alerts are often delayed

- No filtering for relevance

- Emails get lost or filtered

- Different systems for each agency

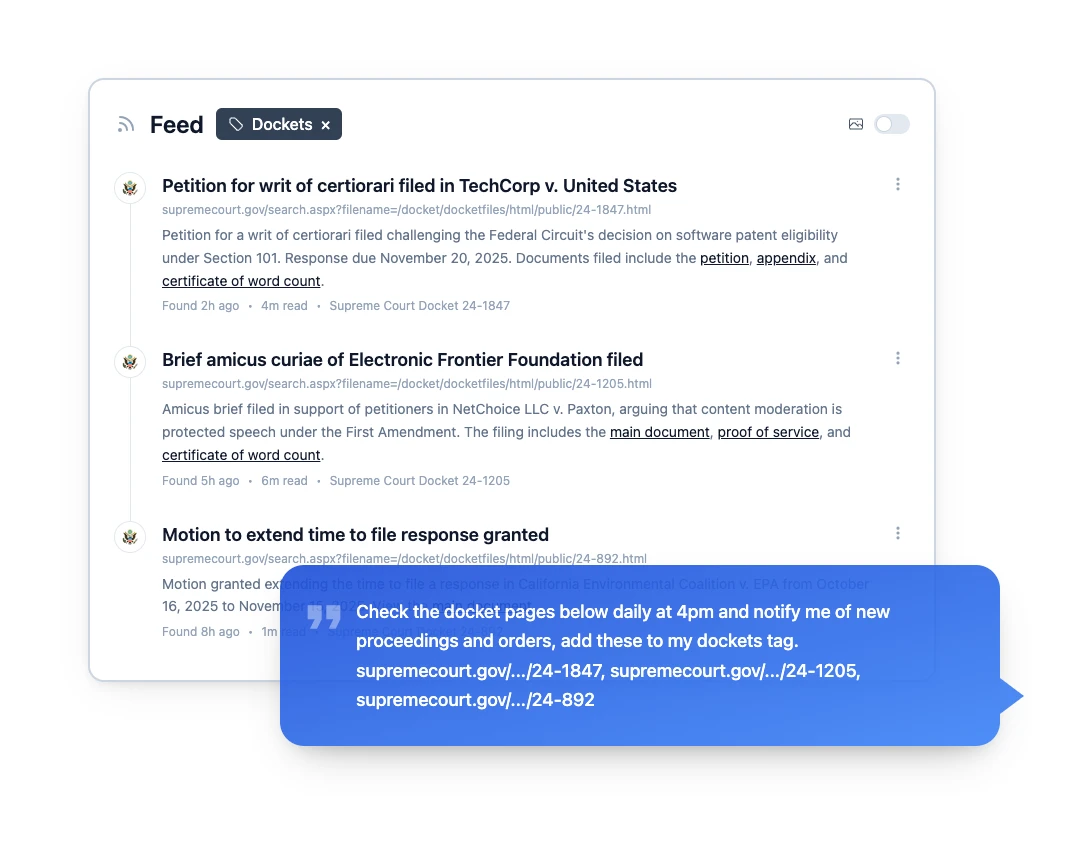

Option 3: Automated Monitoring

Tools like Changeflow monitor regulatory websites automatically. When a page changes, you get an alert with exactly what changed.

How it works:

- Add the regulatory pages you need to track

- Tell the AI what you care about (guidance updates, enforcement actions, etc.)

- Get alerts when relevant changes happen

- AI summarizes what changed and why it matters

No more manual checking. No more missed updates. One dashboard for all your regulatory monitoring.

Building a compliance monitoring program starts with knowing what to watch and automating the process so nothing slips through.

Start Tracking Regulatory Changes Today

Compliance failures happen when teams miss updates. A rule changes. A guidance document is revised. A deadline shifts.

Changeflow monitors regulatory websites so you don't have to. FDA, SEC, FTC, state agencies, whatever you need to track. Get alerts when something changes, with AI summaries that tell you what matters.

Used by compliance teams at Fortune 500 companies, Am Law 200 firms, and healthcare organizations.

Track regulatory changes automatically

Get notified when the pages you care about change. FDA, SEC, state agencies, whatever you need.

Try Changeflow FreeNo credit card required

More from Learn

MAP Pricing: Monitor Minimum Advertised Prices

What is MAP pricing? Learn how brands enforce minimum advertised prices, monitor violations, and protect margins. Monitoring guide included.

Best Competitive Intelligence Tools in 2026

Compare the best competitive intelligence tools for 2026. Website monitoring, market analysis, and competitor tracking reviewed.

How to Monitor Competitor Websites in 2026

Learn how to monitor competitor websites for pricing, product, and content changes. Tools, strategies, and what to track.