INVESTMENT INTELLIGENCE

Spot corporate changes before markets react

Filing alerts flood your inbox with noise. We filter to what matters and explain the signal.

Trusted by investment professionals and research firms

AI-powered investment intelligence

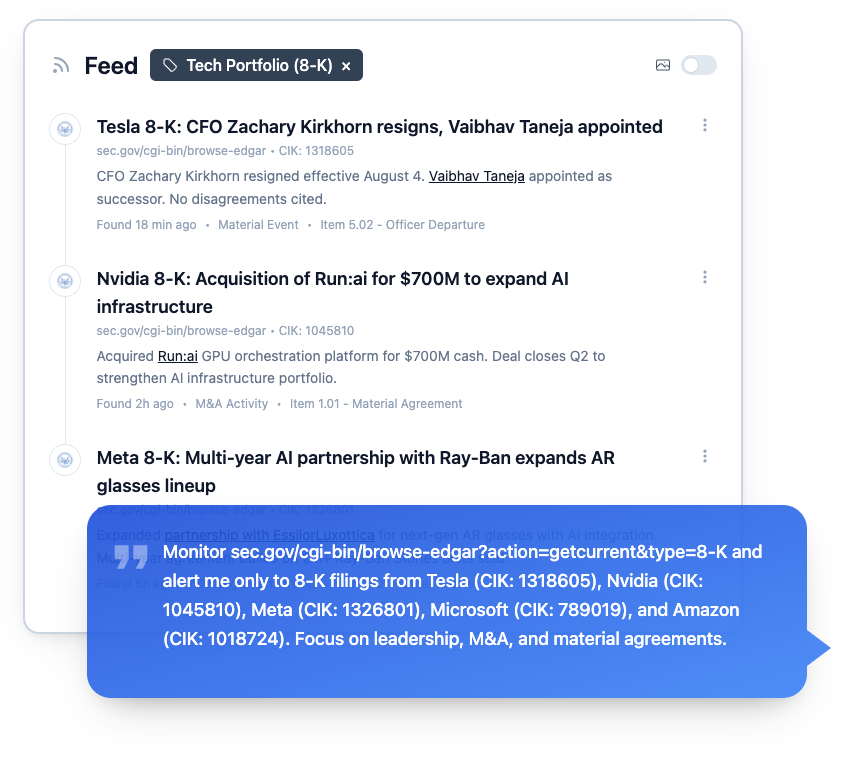

Set up in seconds with company tickers, SEC filing types, and a simple prompt explaining what events matter to you. Sit back and let Changeflow intelligently monitor markets for you.

- ✓ AI understands SEC filings, material events, and what moves markets

- ✓ Automatically filters noise, surfaces only significant corporate signals

- ✓ Summarizes filings and provides context on investment implications

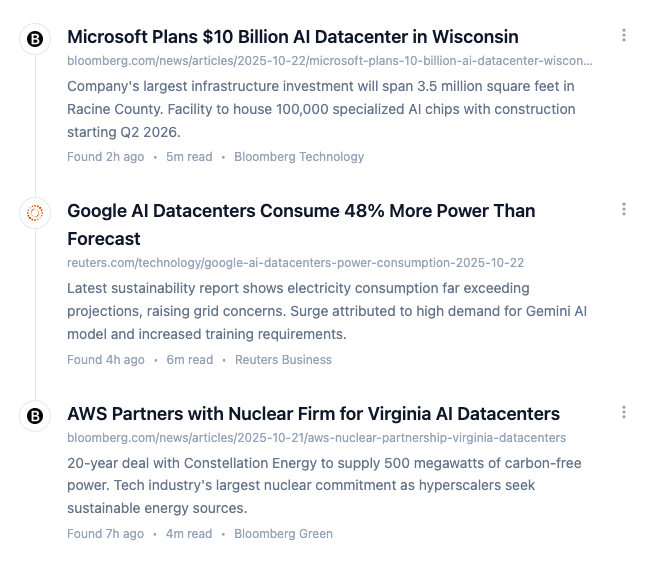

- ✓ Aggregate hundreds of companies and filing types into a unified feed

- ✓ Track SEC Edgar, investor relations pages, board changes, and proxy statements

The Changeflow advantage for investment research

Financial Intelligence AI

Our AI is optimized for understanding SEC filings, regulatory language, and corporate disclosures. It understands what constitutes a material event vs. routine filing.

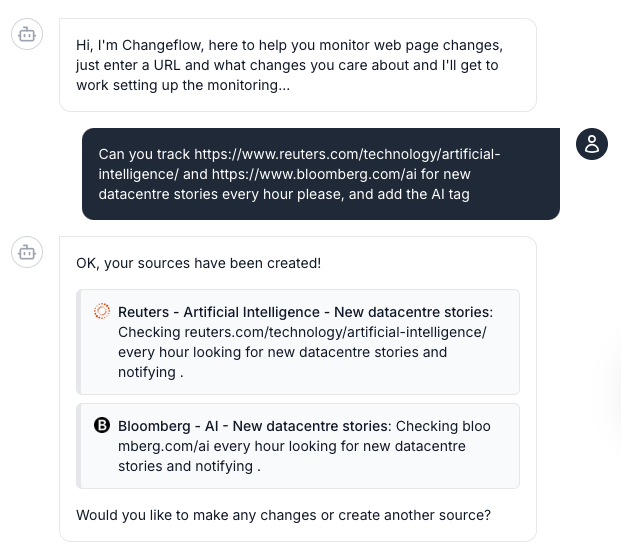

Natural language setup

No complex queries. Tell us: 'Alert me when portfolio companies file 8-Ks about leadership changes' or 'Track insider buying for my watchlist'. We handle the rest.

Intelligent summarization

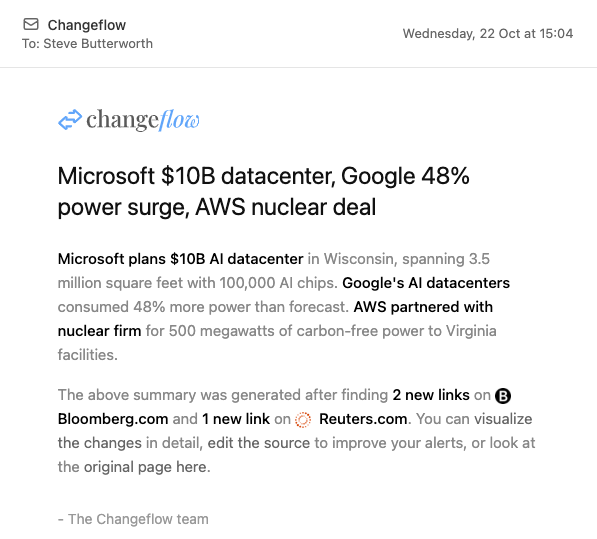

Don't waste time reading full 10-Ks. Get AI-generated summaries of filings with key takeaways and investment implications.

Multi-company monitoring

Track your entire portfolio, watchlist, or sector in one unified feed. Monitor 50, 100, or 500+ companies simultaneously for material events.

Real-time alerts

Get notified within minutes of SEC filings. Critical for time-sensitive trading decisions and getting ahead of market reactions.

Materiality filtering

Our AI automatically filters for significant events. You only see filings and changes that could move markets or impact valuations.

Optimized for tracking key investment sources

Changeflow has been optimized and rigorously tested to reliably monitor SEC filings, corporate disclosures, and investor relations sources. Our AI understands regulatory language, materiality, and what constitutes actionable investment intelligence.

SEC Edgar 8-K

sec.gov/edgar

Form 4 Insider Trading

sec.gov/cgi-bin/browse-edgar

13F Holdings

sec.gov/form13f

10-K Annual Reports

sec.gov/edgar

10-Q Quarterly Reports

sec.gov/edgar

Proxy Statements

sec.gov/proxy

Investor Relations

company.com/investors

Board Composition

company.com/board

Earnings Transcripts

seekingalpha.com

Corporate Governance

company.com/governance

M&A Databases

mergermarket.com

Activist Campaigns

13d.com

Plus any other website or data source you need to track. If it's online, Changeflow can monitor it.

How investment professionals use Changeflow

Material event monitoring

Portfolio managers and equity analysts

Challenge: Missing material 8-K filings means slower reaction time and lost alpha when events move markets

Solution: Monitor SEC Edgar for 8-K filings across your portfolio with AI filtering for significant events like leadership changes, acquisition announcements, and material agreements.

Outcome: React to material events within minutes, not hours. Make informed decisions before markets fully digest news.

A hedge fund caught an unexpected CEO departure 8-K filing 15 minutes after submission, exiting their position before the stock dropped 12% the next day.

Insider trading signals

Quantitative analysts and investment researchers

Challenge: Tracking Form 4 insider trading across hundreds of companies manually is impossible

Solution: Set up feeds for Form 4 filings filtered by transaction type, insider role, and transaction size. Track insider buying patterns as early signals of value.

Outcome: Identify conviction signals from insider buying before broader market awareness. Spot red flags from executive selling.

An investment research firm tracks Form 4s for 200 mid-cap companies and identified unusual director buying that preceded a 40% run-up over 3 months.

Portfolio company tracking

Private equity and venture capital investors

Challenge: Staying informed on governance changes, board appointments, and strategic shifts across portfolio companies

Solution: Monitor portfolio company investor relations pages, proxy statements, and corporate governance updates for board changes, compensation shifts, and strategic announcements.

Outcome: Stay informed on portfolio developments without constant check-ins. Identify issues early before they impact valuations.

A PE firm tracks 25 portfolio companies and caught an unexpected board resignation that signaled internal conflict, prompting early intervention before operational issues escalated.

Automated web intelligence

A URL and brief description of what you care about is all you need.

1 Describe what matters

Tell our AI agent what URLs to monitor and a brief description of what updates you want to be told about. No technical setup or manual configuration required.

2 Let our AI agent track the pages

The platform navigates to pages, checks for updates and uses AI to determine the relevance of the changes. Your personalized feed surfaces only what matters.

"Changeflow is an awesome tool, we've tried all of the alternatives and at last we have found something that just works! We use the chatbot to add multiple pages at a time, so quick and easy."

Rachel White

Director, Working Planet

Simple pricing, for your team

Our software is 100% focussed on business. All plans offer comprehensive features and support.

Plus

Ideal for getting started with change detection, 20 to 300 pages monitored.

$14/mo

-

Track

20pages

- Email & chat support

- Onboarding calls & fast troubleshooting

- Hourly, daily & weekly checks

- 10 versions saved

- 2 notification addresses

- Centralized user admin & billing

Business

Ideal for teams that need to monitor changes on more web resources.

$14/mo

-

Track

20pages

- Everything in Plus, plus

- Expert email & chat support

- 20 versions saved

- 5 notification addresses

- Import from CSV, Excel & Site crawl

- Premium page unblocker

Enterprise

Ideal for teams that need to monitor and organise many web sources.

Custom pricing

-

Track

unlimitedpages

- Everything in Business, plus

- Allows 10 minute check frequency

- 50 versions saved

- 10 users included

- Unlimited notification addresses

- Dedicated account manager

- Concierge setup & onboarding

- Custom plans & payment methods

Have a question? Get in touch. Not ready to pay? Try for free.

Frequently asked questions

If you can't find what you're looking for, email our support team and we'll get back to you with answers quickly.

-

Which SEC filing types can Changeflow monitor?

Changeflow can monitor all SEC Edgar filing types including 8-K (material events), 10-K (annual reports), 10-Q (quarterly reports), Form 4 (insider trading), 13F (institutional holdings), proxy statements (DEF 14A), S-1 (IPO registrations), and more. You can filter by specific filing types or track all filings for your companies.

-

How quickly are new SEC filings detected?

Changeflow checks SEC Edgar as frequently as every 15 minutes for time-sensitive monitoring. Most filings are detected within 15-30 minutes of submission to Edgar. You can adjust check frequency based on your needs and trading strategy.

-

Can I track insider trading (Form 4 filings)?

Yes! Form 4 insider trading filings are one of our most popular use cases. Set up prompts like 'Alert me when executives buy shares' or 'Track insider selling above $1M for my watchlist'. Our AI can filter by transaction type, insider role, transaction size, and more.

-

Does Changeflow provide filing summaries?

Yes, our AI automatically generates summaries of SEC filings highlighting key information, material changes, and investment implications. This saves you from reading full 10-Ks or parsing dense 8-Ks to find what matters for your investment thesis.

-

Can I monitor my entire portfolio at once?

Absolutely. Upload your portfolio tickers and specify which filing types or events you care about. Changeflow will monitor all companies simultaneously and aggregate material events into one unified feed. Many funds monitor 100-500+ companies this way.

-

What about non-SEC sources like investor relations pages?

Yes! Beyond SEC Edgar, Changeflow can monitor company investor relations pages, corporate governance pages, board composition pages, and proxy statements. This catches updates that don't require SEC filings like advisory board appointments or ESG disclosures.

-

Can I track institutional holdings (13F filings)?

Yes. Track 13F filings to see which institutional investors are buying or selling specific stocks. Set up alerts for when major funds change positions in your watchlist companies or when new investors take significant stakes.

-

How does materiality filtering work?

Our AI is trained on thousands of SEC filings and corporate events to understand what typically moves markets. It filters for significant events like leadership changes, M&A activity, material agreements, restatements, and regulatory issues while suppressing routine administrative filings.

-

Can I share feeds with my investment team?

Yes. Share feeds with team members, export filing reports, or integrate with Slack/Teams for automatic notifications to research channels. Set up role-based access so analysts see detailed feeds while PMs see summaries.

-

Is this legal for investment research?

Yes, Changeflow only monitors publicly available information from SEC Edgar and company websites. All filings and disclosures we track are public information required by securities regulations. This is standard investment research practice used by institutional investors.

START MONITORING MARKET-MOVING EVENTS IN 60 SECONDS

Join over 300 investment professionals who never miss material events

- 30-day free trial, no credit card required

- Setup takes 60 seconds with AI assistance

- Cancel anytime, no long-term contract

Questions? Our specialists are here to help, just email hello@changeflow.com