What is EDLP pricing? Learn the everyday low price strategy with real examples from Walmart, Costco, and more. Pros, cons, and alternatives.

EDLP pricing is one of the most misunderstood strategies in retail. Everyone thinks they know what it means. Walmart does it. Costco does it. Must be simple, right?

Not quite. Everyday low pricing sounds straightforward, but the mechanics behind it determine whether a business thrives or bleeds money. This guide breaks down how EDLP actually works, who it works for, and how to tell if your competitors are really following through on their "low price" promises.

What Is EDLP Pricing?

EDLP stands for Everyday Low Price. It's a pricing strategy where a retailer sets prices low and keeps them there. No weekly sales. No "limited time offers." No coupon clipping. The price you see today is the price you'll see next month.

The idea is simple: customers trust that they're getting a fair price every time they walk in. They don't need to wait for a sale or compare flyers. That trust drives repeat visits and consistent revenue.

Walmart built a $600 billion empire on this concept. Their tagline, "Save Money. Live Better," isn't just marketing. It's the operational philosophy behind every buying decision, supplier negotiation, and store layout choice they make.

But EDLP isn't just "charge less." It's a system. And the system only works if the cost structure supports it.

How Everyday Low Pricing Works

EDLP requires three things working together:

1. Low cost structure. You can not offer low prices without low costs. Walmart spends roughly 19% of revenue on operating expenses, compared to 25%+ for many traditional retailers. They achieve this through supply chain efficiency, massive scale, and relentless cost-cutting.

2. High volume. Low margins only work with high turnover. A product that sits on the shelf for weeks at a low price is a money loser. EDLP retailers need consistent foot traffic and fast inventory turns to make the math work.

3. Supplier partnerships. EDLP retailers negotiate differently. Instead of asking for promotional allowances and slotting fees, they negotiate the lowest possible consistent wholesale price. Suppliers benefit from predictable demand. Retailers benefit from lower costs.

The result: prices stay flat. Customers know what to expect. And the business makes money on volume, not margins.

Paste a URL. We'll do the rest.

Changeflow monitors the page and tells you what changed and why it matters.

Free plan available. No credit card required.

Real EDLP Examples

Walmart

The textbook EDLP example. Walmart introduced "Everyday Low Prices" in 1974 under Sam Walton. Today it's the world's largest retailer by revenue.

Their approach: negotiate the lowest possible cost from suppliers, keep operating expenses minimal, pass savings to customers. They do run "Rollback" promotions on select items, but the base pricing philosophy stays EDLP.

What makes it work: $611 billion in annual revenue. At that scale, even tiny margins per item add up to massive profits.

Costco

Costco takes EDLP further with a membership model. They cap markups at 14% on most products (compared to 25-50% at traditional retailers). The membership fee ($65/year for basic) generates the bulk of their profit.

Their private label, Kirkland Signature, keeps prices even lower by cutting out brand premiums. Members trust they're getting the best available price without needing to comparison shop.

Trader Joe's

Trader Joe's runs a focused version of EDLP. Limited selection (around 4,000 SKUs versus 30,000+ at a typical grocery store), mostly private label, and consistently low prices. No loyalty cards. No weekly flyers.

By stocking fewer items, they reduce complexity and negotiate better supplier deals. The tradeoff: you can not get everything on your list. But what they do carry is cheap and usually good.

ALDI

ALDI might be the purest EDLP play in grocery. Bare-bones stores. Limited selection. Over 90% private label. Customers bag their own groceries. Every operational decision is designed to minimize cost and keep prices low.

The result: ALDI's grocery prices run 15-30% below traditional supermarkets, according to multiple retail industry analyses.

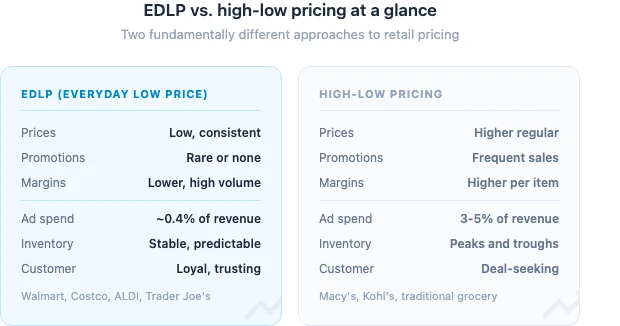

EDLP vs High-Low Pricing

This is the fundamental choice in retail pricing. Every retailer leans one way or the other.

| Factor | EDLP | High-Low Pricing |

|---|---|---|

| Regular prices | Low, consistent | Higher than EDLP |

| Promotions | Rare or none | Frequent sales and coupons |

| Customer behavior | Predictable, loyal | Deal-seeking, stockpiling |

| Margins | Lower per item, higher volume | Higher per item, variable volume |

| Advertising costs | Lower (no weekly flyers) | Higher (constant promotion) |

| Inventory management | Stable, predictable | Peaks and troughs around sales |

| Examples | Walmart, Costco, ALDI | Macy's, Kohl's, traditional grocery |

| Best for | High-volume, cost-focused | Differentiated, brand-focused |

High-low pricing charges more normally but offers frequent sales. Think Kohl's with their perpetual 40% off coupons. Or traditional grocery stores with weekly specials.

The psychology is different too. EDLP customers value simplicity and trust. High-low customers enjoy the thrill of finding a deal. Both work. But they attract fundamentally different shoppers.

Some retailers blend both approaches. Walmart's Rollback promotions add a high-low element to their EDLP base. Target runs sales while keeping everyday prices competitive. The line isn't always clean.

Pricing strategies shift in real time. Understanding how competitors adjust their approach helps you decide whether EDLP, high-low, or a hybrid model fits your business.

Pros of EDLP Pricing

Predictable revenue. No feast-and-famine cycles around promotions. Demand stays relatively stable week to week, which makes forecasting, staffing, and inventory planning much easier.

Lower marketing costs. No weekly circulars. No "SALE ENDS SUNDAY" banners. Walmart spends roughly 0.4% of revenue on advertising. Traditional retailers spend 3-5%.

Customer trust and loyalty. Shoppers don't feel the need to wait for a sale. They buy when they need something, knowing the price is fair. That trust builds long-term loyalty.

Simpler operations. No constantly changing price tags. No promotional displays to build and tear down. No complex discount logic at the register. Less operational overhead overall.

Supplier stability. Consistent orders at predictable volumes. Suppliers can plan production and logistics more efficiently, which often translates to better pricing for the retailer.

Cons of EDLP Pricing

Thin margins. There's no margin cushion. Every cost increase hits harder when your prices are already as low as possible. One bad quarter can hurt.

Requires scale. Walmart can negotiate prices that smaller retailers simply can not. Without massive buying power, maintaining truly low prices while staying profitable is extremely difficult.

Less excitement. No sales means no urgency. Some customers need that "deal" feeling to trigger a purchase. EDLP can feel boring compared to a 50% off event.

Hard to raise prices. When your brand is built on low prices, any increase feels like a betrayal. Customers notice. And they complain loudly.

Vulnerability to price wars. If a competitor undercuts your everyday low price, you're stuck. You can not just "run a sale." You need to permanently lower your price or accept losing those customers.

When to Use an Everyday Low Price Strategy

EDLP works best when:

- You have volume. High traffic, fast inventory turns, consistent demand.

- Your costs are genuinely low. Efficient supply chain, low overhead, strong supplier deals.

- Your customers prioritize value over brands. Price-sensitive shoppers who buy on trust, not excitement.

- You can sustain it long-term. This isn't a temporary promotion. It's a permanent commitment.

EDLP probably won't work if:

- You're a small retailer without buying power

- Your products are highly differentiated (luxury, specialty, artisan)

- Your customers expect deals and promotions as part of the shopping experience

- Your cost structure can not support consistently low prices

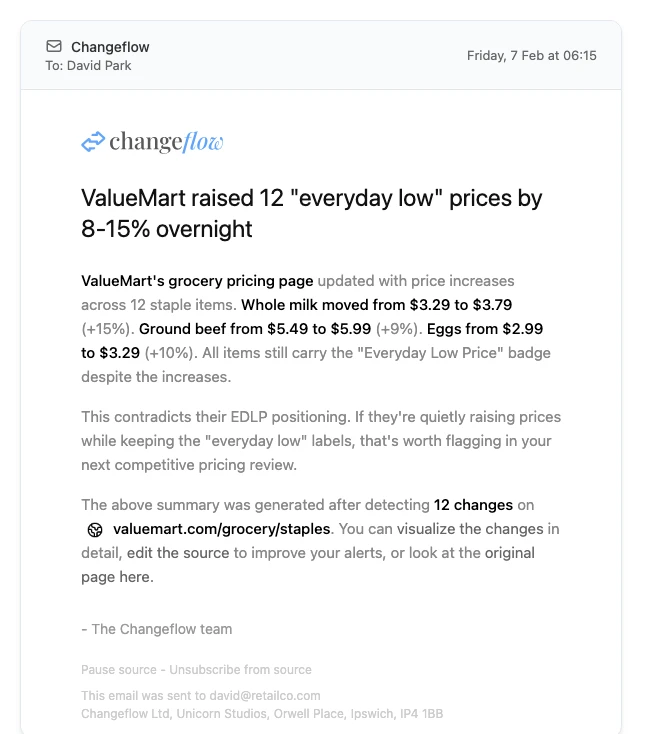

How to Monitor Competitor EDLP Compliance

Here's something most pricing guides won't tell you: many retailers claim EDLP but don't actually follow through. They quietly raise prices, run stealth promotions, or let "everyday low prices" creep upward over time.

If you're competing with an EDLP retailer (or enforcing MAP pricing across your distribution network), you need to verify their pricing claims, not just take them at face value.

Track Pricing Pages Automatically

Use Changeflow to monitor competitor pricing pages. Add their product or pricing URLs, tell the AI to alert you when prices change, and build a record of their actual pricing behavior over time.

If a competitor claims "everyday low prices" but changes prices weekly, you'll have the data to prove it. Useful for your own competitive positioning, and potentially valuable in MAP compliance disputes.

What to Monitor

- Product pricing pages for actual price changes

- Promotional banners that contradict EDLP claims

- Terms and conditions for hidden surcharges

- Competitor press releases announcing pricing changes

You can set this up in minutes with Changeflow's website change detection. Track any public webpage and get AI-powered alerts when something changes.

For a full breakdown of monitoring tools, see our competitor price tracking tools guide or explore price intelligence tools for more advanced options.

EDLP and Your Pricing Strategy

EDLP isn't right for everyone. But understanding it is important regardless of your approach.

If you're competing against EDLP retailers, you need to differentiate on something other than price. Service, selection, convenience, brand experience.

If you're a brand selling through EDLP retailers, understand their expectations. They want the lowest cost, consistent supply, and minimal complexity. Plan accordingly.

And if you're considering EDLP for your own business, be honest about whether you can sustain it. A failed EDLP strategy (where you raise prices after promising low ones) damages trust more than never offering low prices in the first place.

Whatever strategy you choose, monitor your competitive landscape so you're never caught off guard by a competitor's pricing move. That's something worth investing in regardless of your approach.

Monitor competitor EDLP compliance automatically

Track whether retailers actually maintain their everyday low prices. Get alerts when prices change.

Try Changeflow FreeNo credit card required

More from Learn

How to Monitor Competitor Websites in 2026

Learn how to monitor competitor websites for pricing, product, and content changes. Tools, strategies, and what to track.

Price Intelligence Tools: Software Comparison in 2026

Compare the best price intelligence tools for 2026. See features, pricing, and honest reviews of Prisync, Competera, Changeflow, and more.

MAP Pricing: Monitor Minimum Advertised Prices

What is MAP pricing? Learn how brands enforce minimum advertised prices, monitor violations, and protect margins. Monitoring guide included.