SEC FILING MONITORING

Smart feeds for every Feeds for every 10-K filing you care about you care about

Investment teams, legal counsel, and compliance officers need real-time visibility into SEC filings. Changeflow monitors EDGAR around the clock, alerting you to material disclosures, regulatory changes, and enforcement actions that matter to your portfolio or clients.

Trusted by investment firms and legal teams

AI-powered SEC monitoring

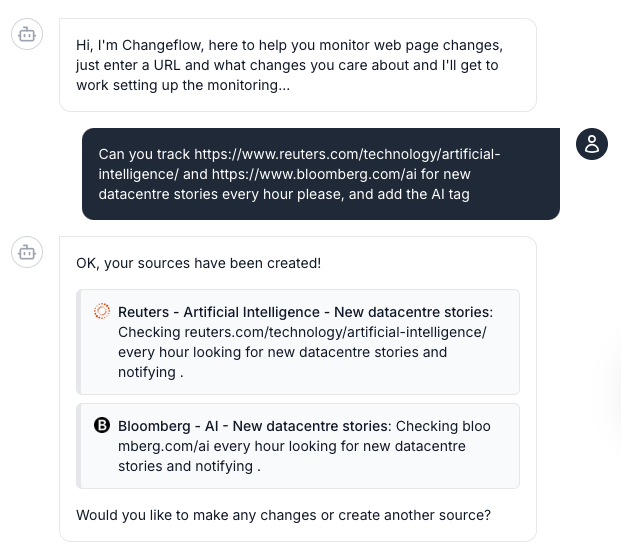

Stop refreshing EDGAR manually. Set up monitoring in seconds with natural language: 'Track all 8-K filings from Tesla' or 'Monitor SEC enforcement actions in fintech.'

- ✓ Monitor specific companies, industries, or filing types

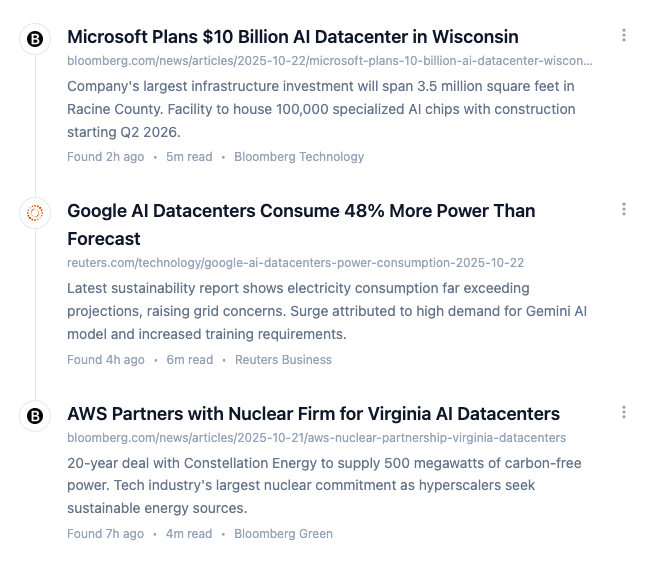

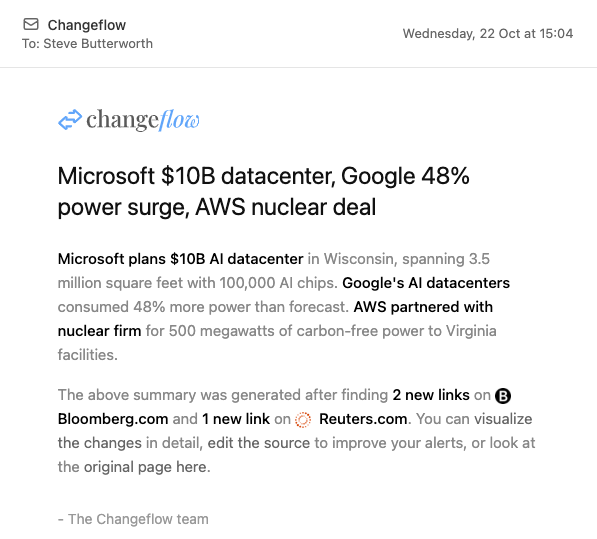

- ✓ Get AI summaries of material disclosures and risk factors

- ✓ Track insider transactions and beneficial ownership changes

- ✓ Archive filings with timestamped proof for compliance

- ✓ Filter by form type, company, SIC code, or custom criteria

Built for investment and compliance teams

SEC-trained AI

Our AI understands SEC filing types, disclosure requirements, and regulatory terminology. It knows the difference between a 10-K and 10-Q, and what makes an 8-K material.

Natural language setup

No EDGAR expertise needed. Just say: 'Monitor 8-K filings from S&P 500 tech companies' or 'Track SEC enforcement actions against hedge funds.'

Disclosure summaries

Get AI summaries of key disclosures, risk factors, and material changes. Focus on what matters without reading entire filings.

Site Version Control

Timestamped archives of every filing and disclosure. Perfect for compliance documentation and audit trails.

Real-time alerts

Get notified within minutes of new EDGAR filings. Never miss a material disclosure or regulatory change.

Reliable monitoring

Consistent access to EDGAR even during high-volume filing periods when other tools struggle.

Optimized for SEC and US financial regulatory sources

Changeflow has been specifically optimized to reliably monitor SEC EDGAR and related US financial regulatory sources. Our AI understands SEC filing types, disclosure requirements, and regulatory language.

SEC EDGAR

sec.gov/edgar

SEC.gov

sec.gov

FINRA

finra.org

Federal Reserve

federalreserve.gov

OCC

occ.treas.gov

FDIC

fdic.gov

CFTC

cftc.gov

Treasury

treasury.gov

PCAOB

pcaob.org

MSRB

msrb.org

State Regulators

nasaa.org

Federal Register

federalregister.gov

Plus any other financial regulatory source you need to track.

How financial teams use Changeflow

Portfolio company monitoring

Investment analysts and portfolio managers

Challenge: Tracking SEC filings across a portfolio of 50+ companies means checking EDGAR constantly or missing material disclosures.

Solution: Set up monitoring for all portfolio companies with AI filtering for material 8-K events, earnings releases, and risk factor changes.

Outcome: Get alerted to material disclosures within minutes, not hours or days after the filing.

A long/short equity fund now catches material 8-K disclosures within 15 minutes, enabling faster trading decisions on earnings surprises and guidance changes.

Competitor disclosure tracking

Corporate strategy and competitive intelligence teams

Challenge: Understanding competitor strategy requires reading their SEC filings, but manually tracking multiple competitors is time-consuming.

Solution: Monitor competitor 10-K, 10-Q, and proxy filings. AI extracts key metrics, strategic priorities, and risk disclosures.

Outcome: Comprehensive competitive intelligence without dedicating staff to EDGAR monitoring.

A Fortune 500 company tracks all SEC filings from 12 key competitors, automatically extracting revenue segments and strategic initiatives.

Insider transaction monitoring

Compliance officers and legal counsel

Challenge: Tracking Form 4 insider transactions and Section 16 compliance requires constant EDGAR monitoring.

Solution: Monitor Form 4 filings for specific companies, executives, or transaction types. Get alerts on unusual insider activity.

Outcome: Stay on top of insider transactions for compliance or investment signal purposes.

A compliance team monitors Form 4 filings for their own company's insiders, ensuring Section 16 violations are caught immediately.

SEC enforcement tracking

Risk management and compliance teams

Challenge: SEC enforcement actions reveal regulatory priorities and industry risks. Missing these insights leaves blind spots in risk management.

Solution: Monitor SEC enforcement releases, administrative proceedings, and litigation releases filtered by industry or violation type.

Outcome: Proactive risk management based on regulatory enforcement trends.

A broker-dealer compliance team tracks all SEC enforcement actions in their sector, updating policies based on enforcement priorities.

Automated web intelligence

A URL and brief description of what you care about is all you need.

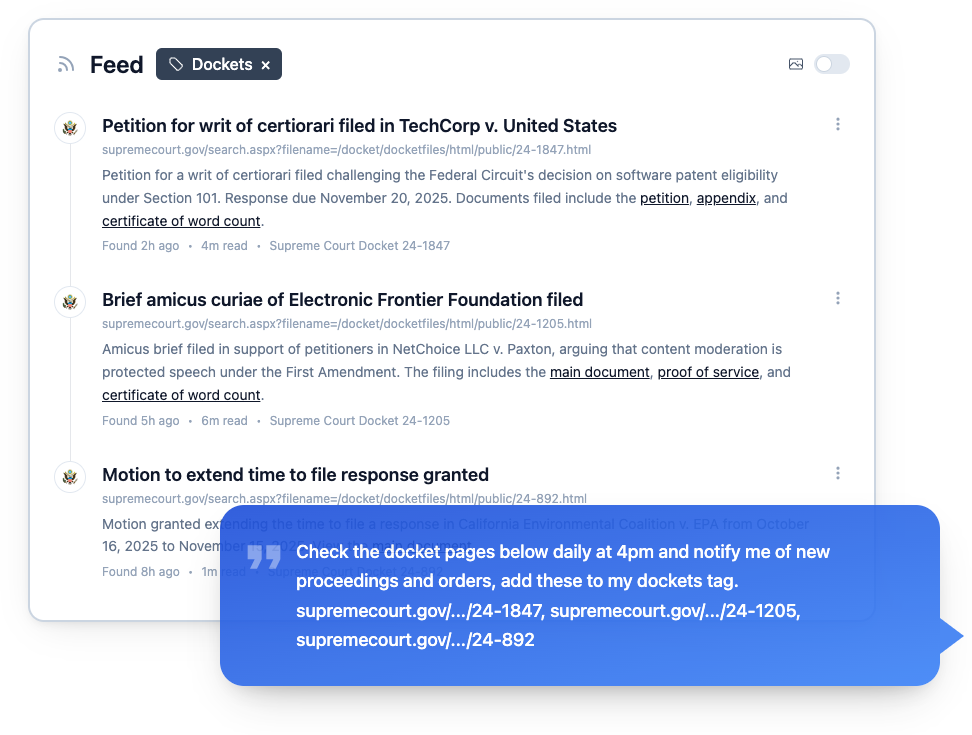

1 Describe what matters

Tell our AI agent what URLs to monitor and a brief description of what updates you want to be told about. No technical setup or manual configuration required.

2 Let our AI agent track the pages

The platform navigates to pages, checks for updates and uses AI to determine the relevance of the changes. Your personalized feed surfaces only what matters.

Simple pricing, for your team

Our software is 100% focussed on business. All plans offer comprehensive features and support.

Plus

Ideal for getting started with change detection, 20 to 300 pages monitored.

$14/mo

-

Track

20pages

- Email & chat support

- Onboarding calls & fast troubleshooting

- Hourly, daily & weekly checks

- 10 versions saved

- 2 notification addresses

- Centralized user admin & billing

Business

Ideal for teams that need to monitor changes on more web resources.

$14/mo

-

Track

20pages

- Everything in Plus, plus

- Expert email & chat support

- 20 versions saved

- 5 notification addresses

- Import from CSV, Excel & Site crawl

- Premium page unblocker

Enterprise

Ideal for teams that need to monitor and organise many web sources.

from$299/mo

-

Track

unlimitedpages

- Everything in Business, plus

- Allows 10 minute check frequency

- 50 versions saved

- 10 users included

- 40 notification addresses

- Concierge setup service

- Dedicated support, training & onboarding

- Custom plans & payment methods

Have a question? Get in touch. Not ready to pay? Try for free.

Frequently asked questions

If you can't find what you're looking for, email our support team and we'll get back to you with answers quickly.

-

Which SEC filing types can Changeflow monitor?

Changeflow can monitor all EDGAR filing types including 10-K, 10-Q, 8-K, proxy statements (DEF 14A), Form 4 insider transactions, 13F holdings, registration statements, and more. You can filter by any combination of form types, companies, or content.

-

How quickly will I be notified of new EDGAR filings?

Most clients receive alerts within 15-30 minutes of a new EDGAR filing. We check EDGAR frequently throughout market hours and can provide near real-time alerts for critical monitoring needs.

-

Can I monitor all filings from a specific company?

Yes! Set up monitoring for any public company by name or CIK number. You can track all filings or filter to specific form types like 8-K only.

-

Can I filter 8-K filings by item type?

Absolutely. Use natural language filtering like 'Monitor 8-K filings with Item 2.01 acquisitions' or 'Track 8-K CEO departures.' Our AI understands 8-K item types and content.

-

How do I monitor SEC enforcement actions?

Set up monitoring for SEC litigation releases, administrative proceedings, and enforcement press releases. Filter by industry, violation type, or specific companies.

-

Can Changeflow help with Section 16 compliance?

Yes. Monitor Form 4 filings for your company's insiders to ensure timely filing and catch any unusual transactions. Also useful for investment firms tracking insider activity.

-

What about monitoring state securities regulators?

Beyond SEC, Changeflow can monitor state securities regulators, FINRA, and other SROs. Set up monitoring for your relevant jurisdictions.

-

How does pricing work for EDGAR monitoring?

Pricing is based on the number of pages/filings you monitor. Most investment teams start with Business tier ($119-$269/month). Enterprise plans with Site Version Control and higher volume start at $299/month.

START MONITORING SEC FILINGS TODAY

Join investment teams who never miss an EDGAR filing

- 30-day free trial, no credit card required

- Setup takes 60 seconds with AI assistance

- Trusted by banks and investment firms

Questions? Our specialists are here to help, just email [email protected]